USDJPY

- Currency Pair: USDJPY

- Position: sell

- Lot Size: 0.02

- Risk/Reward Ratio: 1.25

- Profit/Loss: -$2.84

Entry Rationale

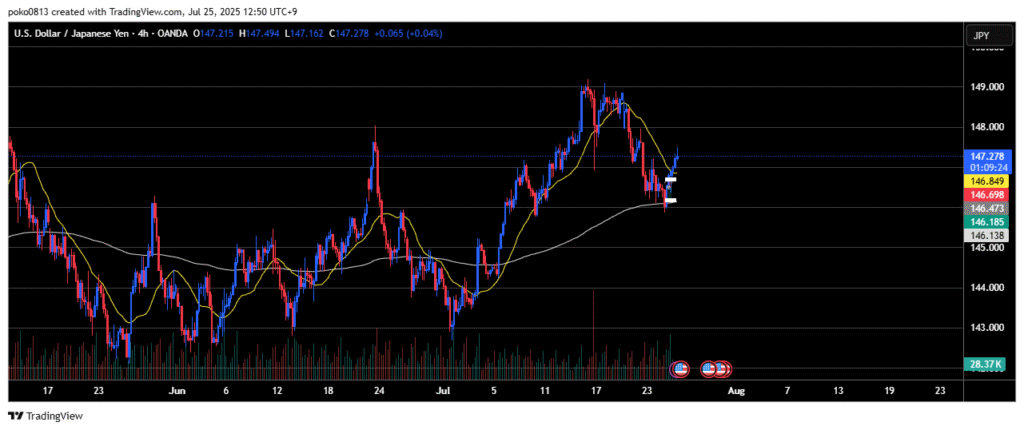

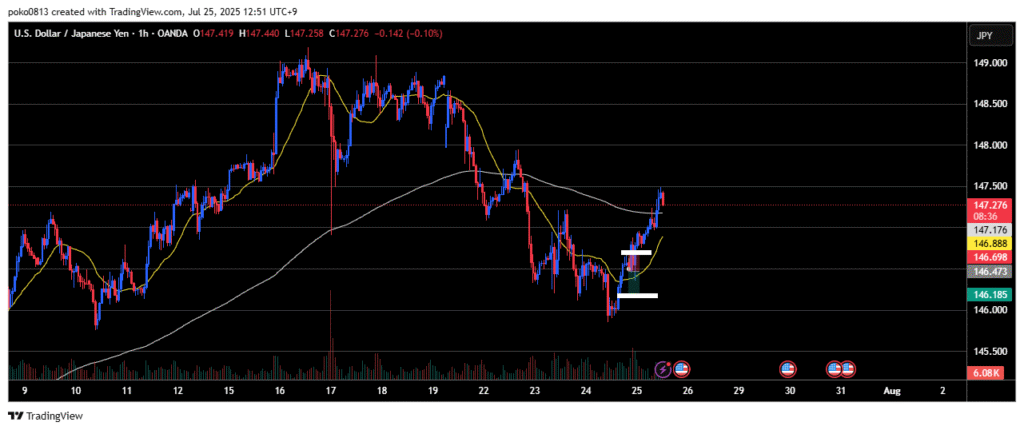

- Bearish outlook on both the 4-hour and 1-hour charts.

- The price has risen up to the area near the last swing high on the 1-hour chart.

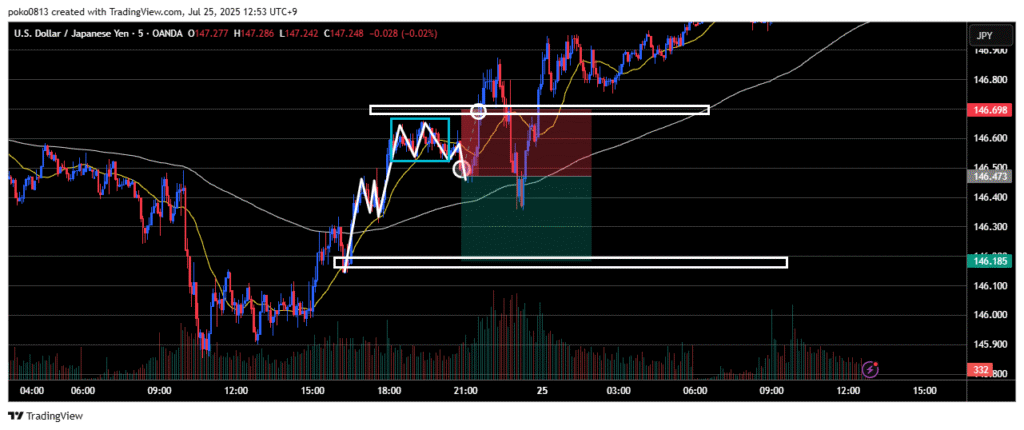

- A double top has formed on the 5-minute chart, and the neckline has been broken.

Explained in detail in the market analysis article below↓

Entry Point, TP and SL Level

4h

1h

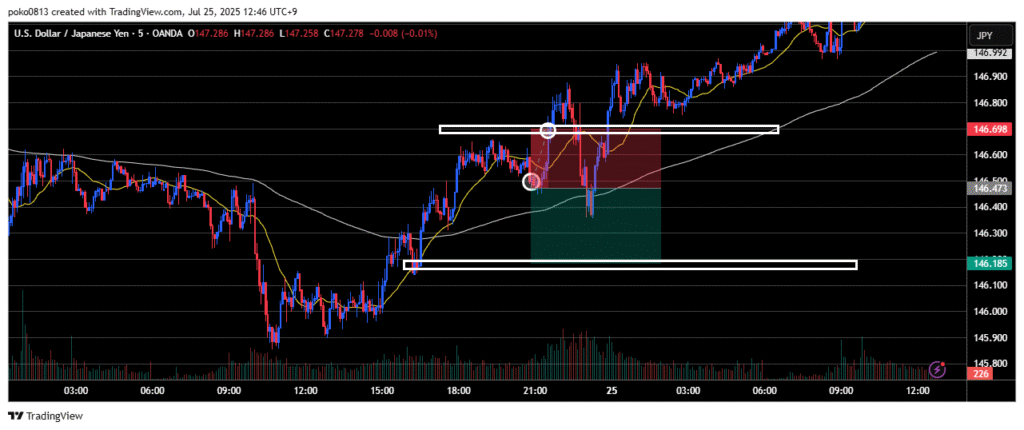

5m

Since a double top had formed on the 5-minute chart, I jumped into a short entry when the neckline was broken.

The take-profit target was set just above the 1-hour chart’s recent low, at a level likely to be respected on the 5-minute chart.

If the price had broken lower, I was planning to extend the take-profit target.

The stop-loss was set at a break above the recent high on the 5-minute chart.

Since the recent high was broken on the 5-minute chart, the position was stopped out.

Trade Review

This trade ended in a stop-out, but it wasn’t a bad setup since it was in the direction of the 1-hour trend.

The stop-loss was placed at the point where the entry rationale would be invalidated, and after being stopped out, the price surged upward—so the trade idea itself wasn’t necessarily wrong.

However, entering a short position before the 5-minute trend had clearly shifted downward wasn’t ideal.

What seemed like a double top turned out to be a fakeout, and in hindsight, forcing the trade led to the loss.