USDJPY Market Analysis and Trading Strategies.

*Personal Opinion

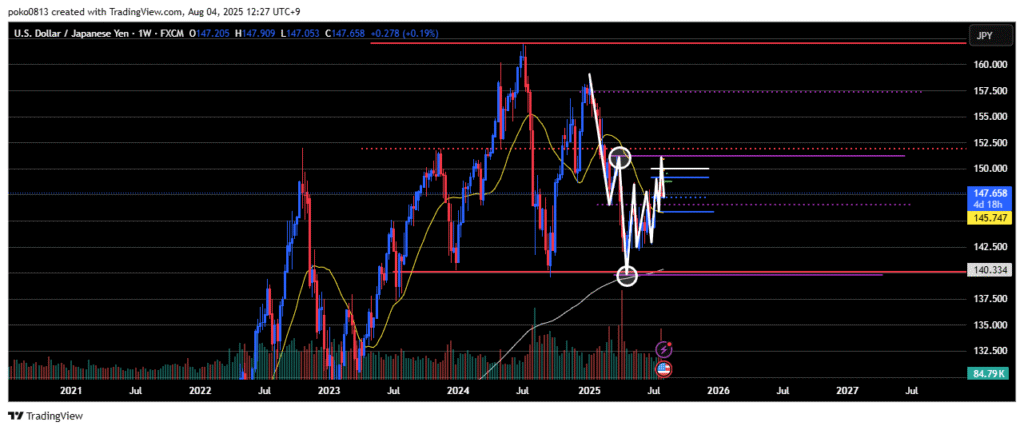

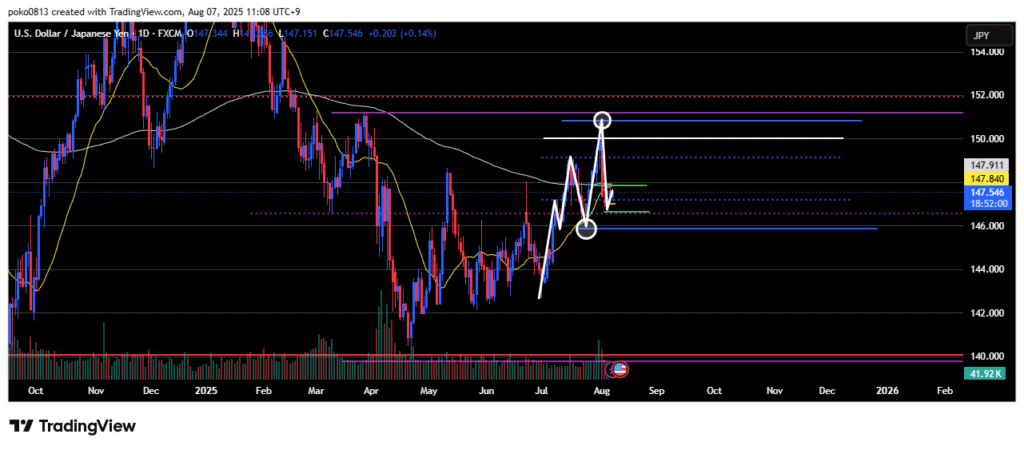

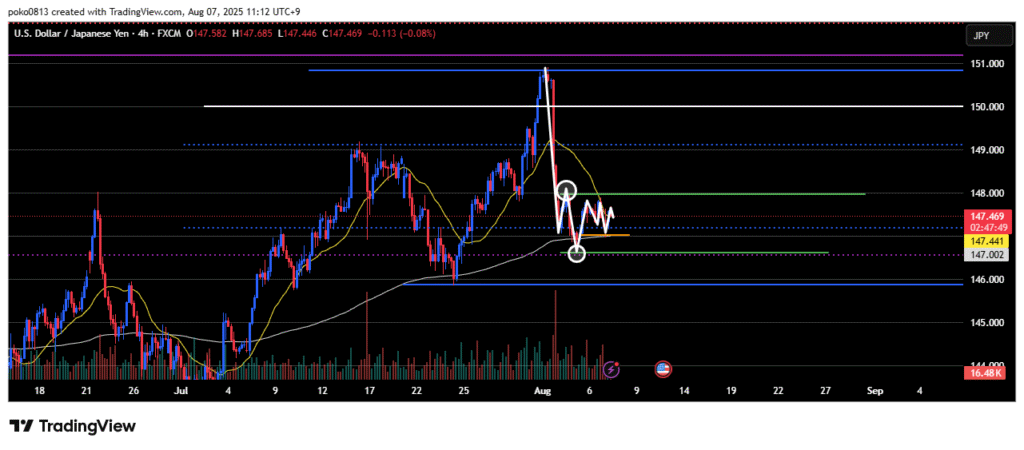

Waveforms of each time leg

Weekly

Last week, the price climbed up to the area around the final swing high of the previous downtrend, but was strongly pushed back down—partly due to the impact of the U.S. Non-Farm Payrolls release.

Since that swing high level hasn’t been clearly broken to the upside, the weekly outlook remains bearish.

Daily

The market is in an uptrend.

The price has pulled back close to the last swing low and is currently showing a slight rebound.

It’s still unclear whether it will continue rising from here, dip once more, or enter a sideways consolidation phase.

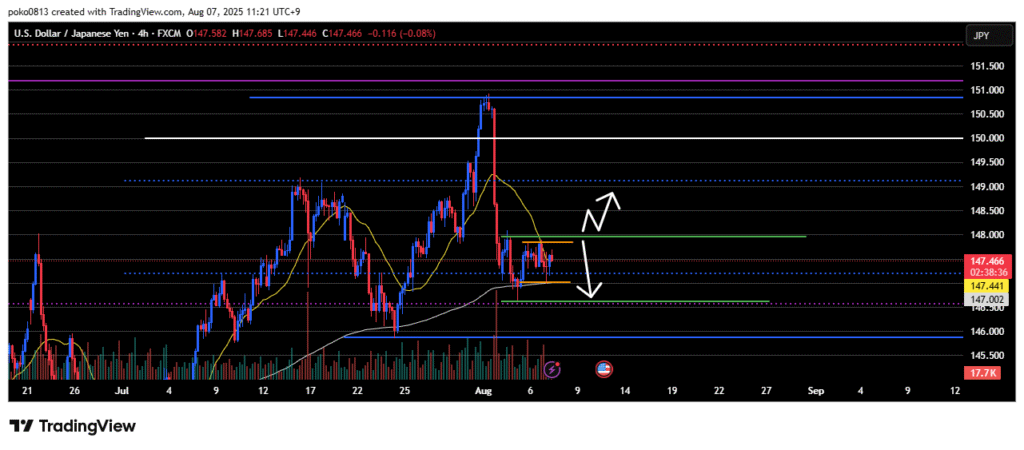

4-Hour

The market is in a downtrend.

Based on Elliott Wave analysis, it appears to be in the third wave of the decline.

However, the move hasn’t extended smoothly, and the price is currently ranging between the recent low and the last swing high.

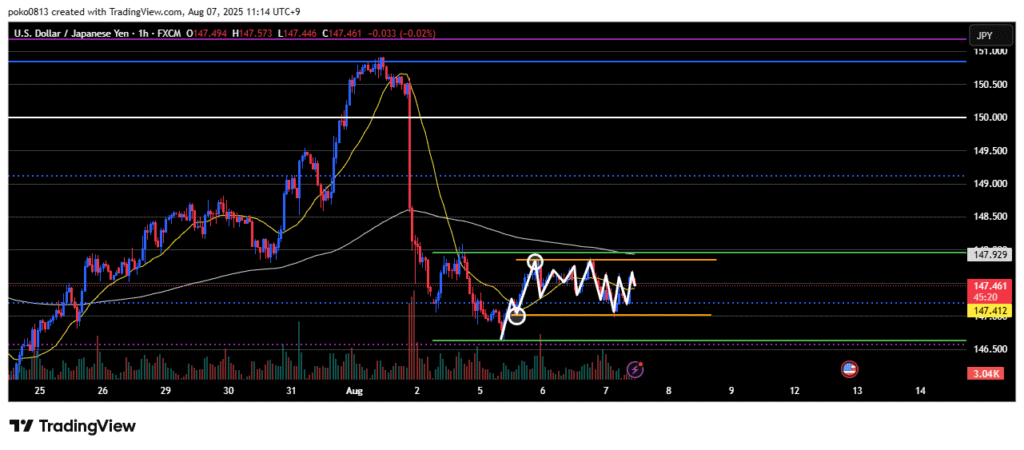

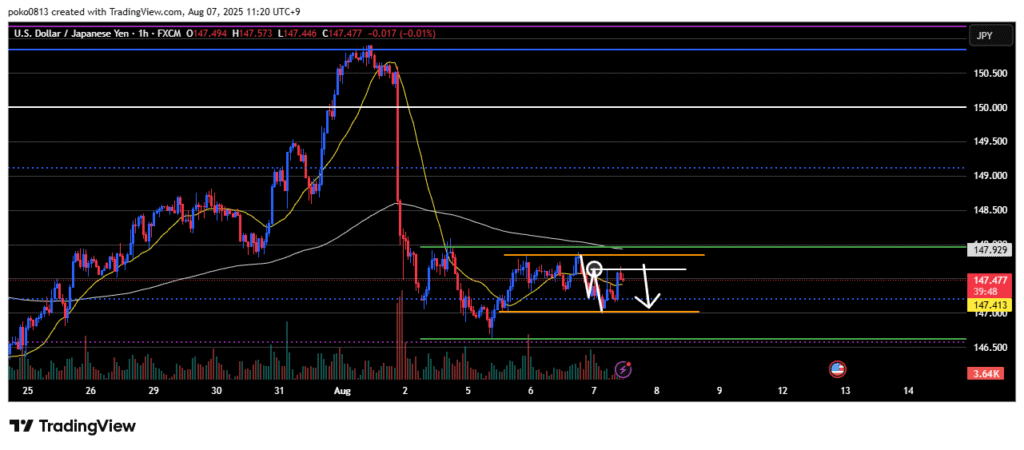

1-Hour

The market can be interpreted as either bullish or bearish in the current state.

On the 1-hour chart, I’m not focusing too much on trend direction, but rather viewing it as a range-bound market within the price zone shown in the image.

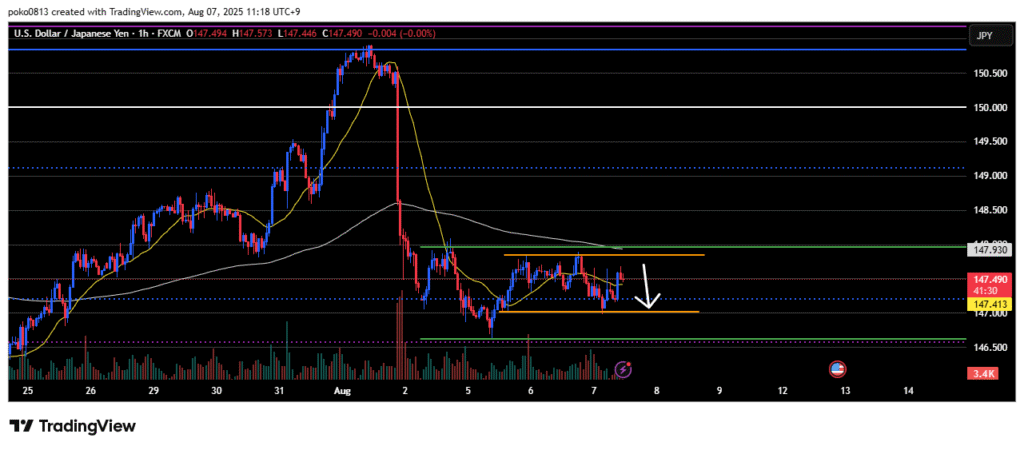

Trade Strategies

Considering a short entry, but only after the price pulls back as close as possible to the upper boundary of the 1-hour range.

The price is currently at the swing high line of the short-term downtrend, so there’s a possibility it could start falling from here.

I’ll continue looking for short setups as long as the last swing high on the 4-hour chart isn’t clearly broken.

If the price breaks above that swing high with confirmation, I’ll switch to a buy-the-dip strategy.