USDJPY Market Analysis and Trading Strategies.

*Personal Opinion

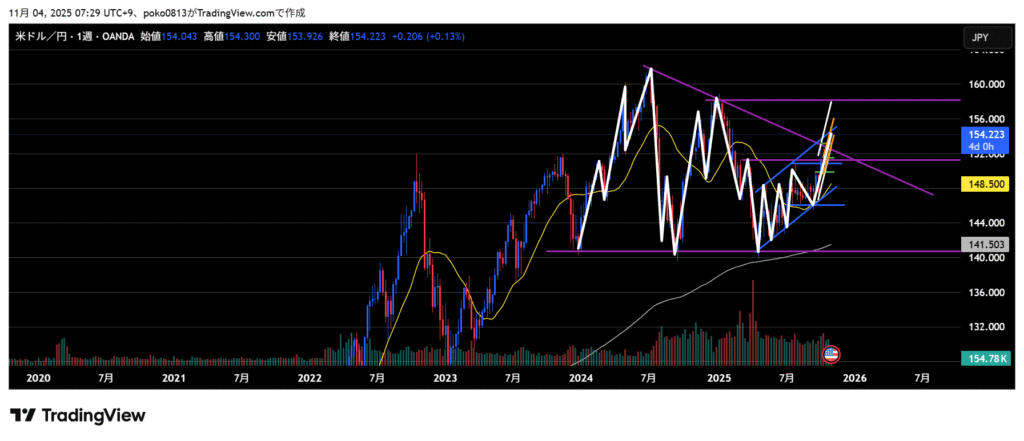

Waveforms of each time leg

Weekly

The price had been moving within a symmetrical triangle, but it has now broken above the upper boundary, showing strong bullish momentum.

If this isn’t a fake-out, there’s a possibility of further upward movement.

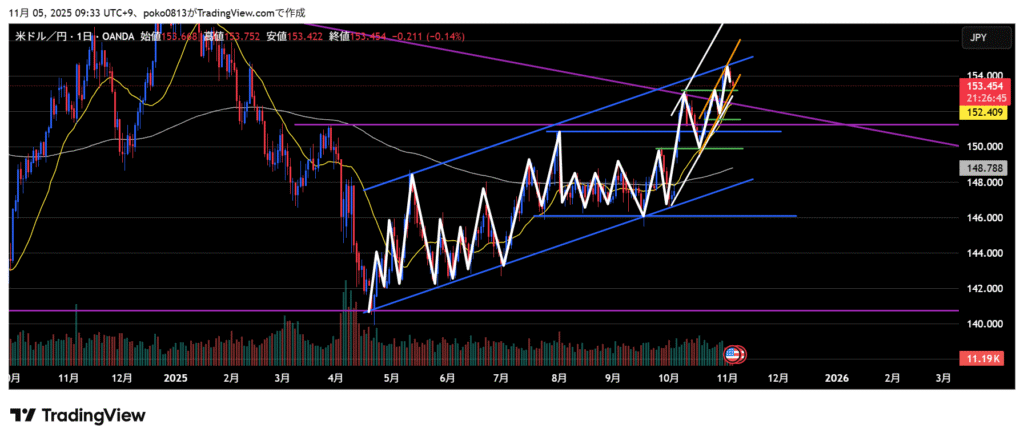

Daily

Uptrend.

The price briefly pulled back at the recent high but continued to rise and is now rebounding from the upper boundary of the ascending channel.

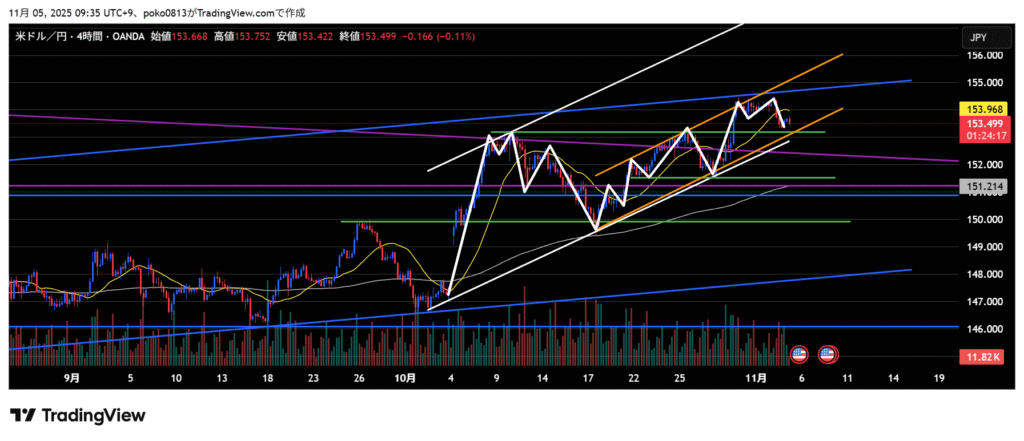

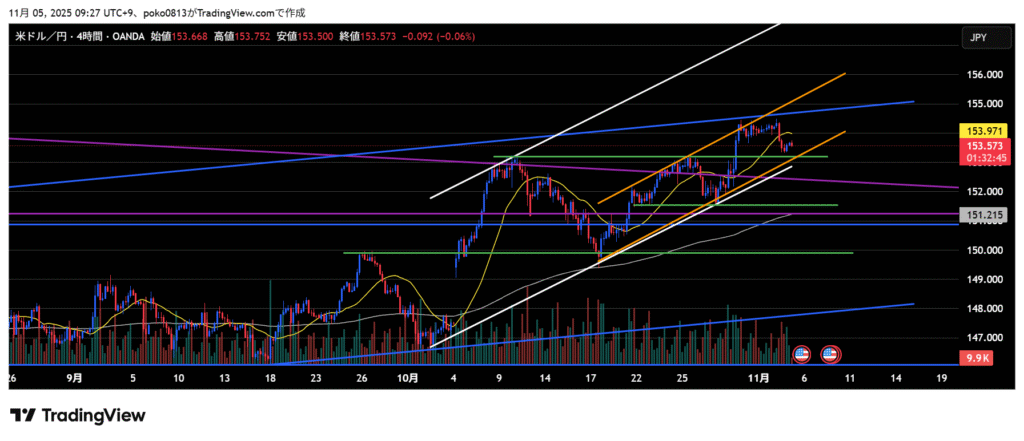

4-Hour

Uptrend.

The price has broken above the previously respected resistance line and has now pulled back to around that level again.

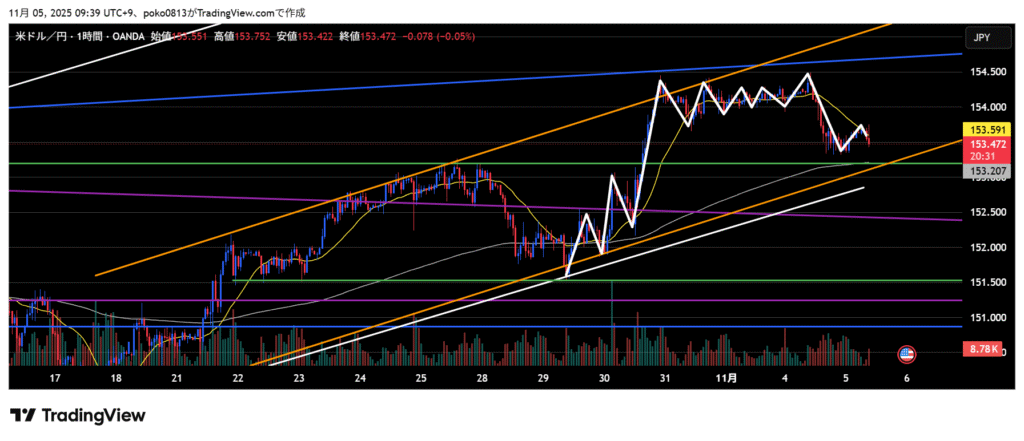

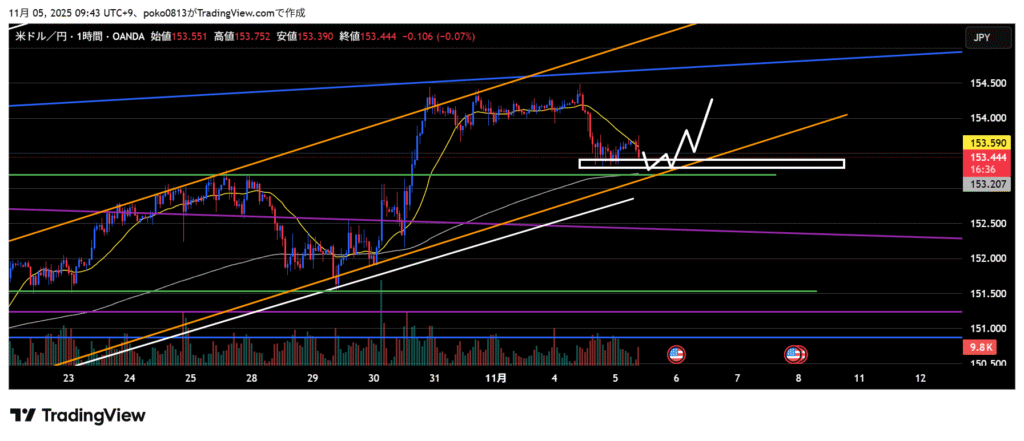

1-Hour

After a period of sideways consolidation, the price broke below the lower boundary of the range, temporarily strengthening the downward momentum.

There’s a possibility that a third wave of decline could occur, but many traders still seem to be looking for buying opportunities.

Trade Strategies

Watch the price action, and if the decline shows signs of stopping, aim for a pullback buy.

Currency Strength

【EURUSD】4H

EUR<USD

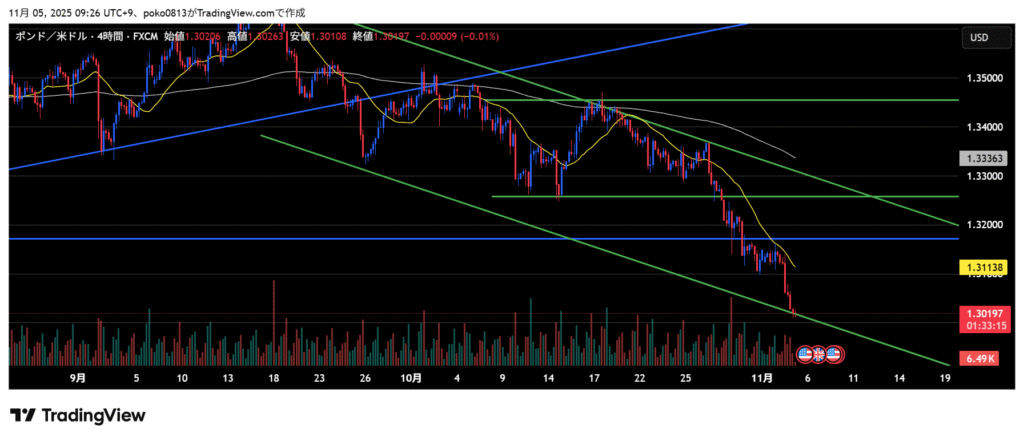

【GBPUSD】4H

GBP<USD

【USDJPY】4H

USD>JPY

【EURJPY】4H

EUR<JPY

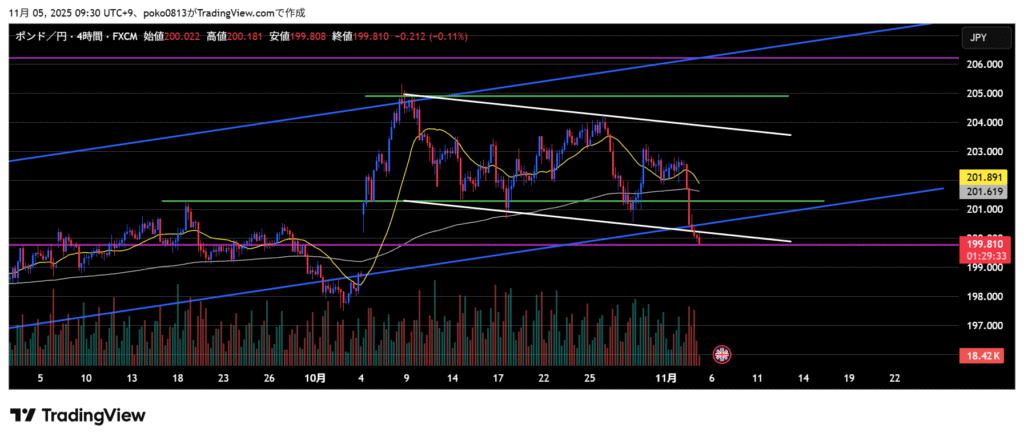

【GBPJPY】4H

GBP<JPY

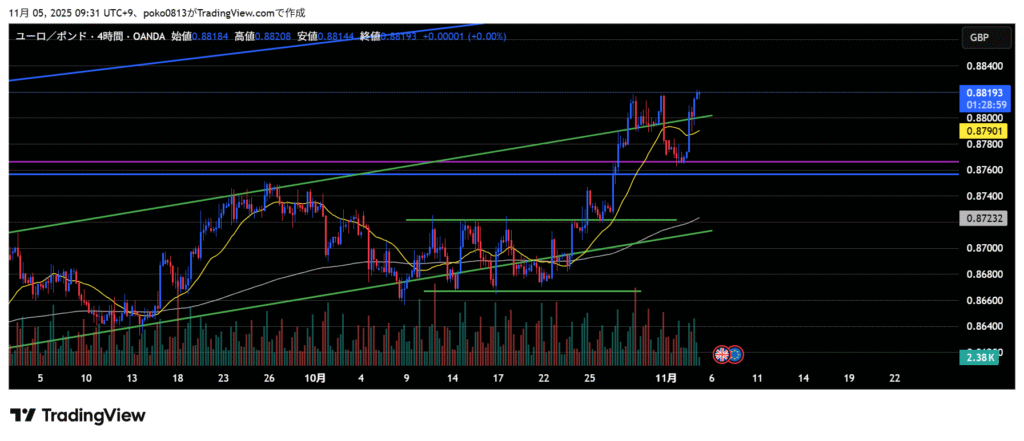

【EURGBP】4H

EUR>GBP

GBP<EUR<JPY<USD