GOLD Market Analysis and Trading Strategies.

*Personal Opinion

Waveforms of each time leg

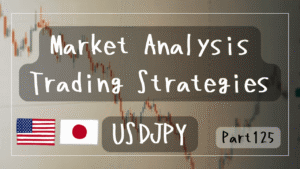

Weekly

Still making new highs.

Recently, price was consolidating but is now rising again near the previous high.

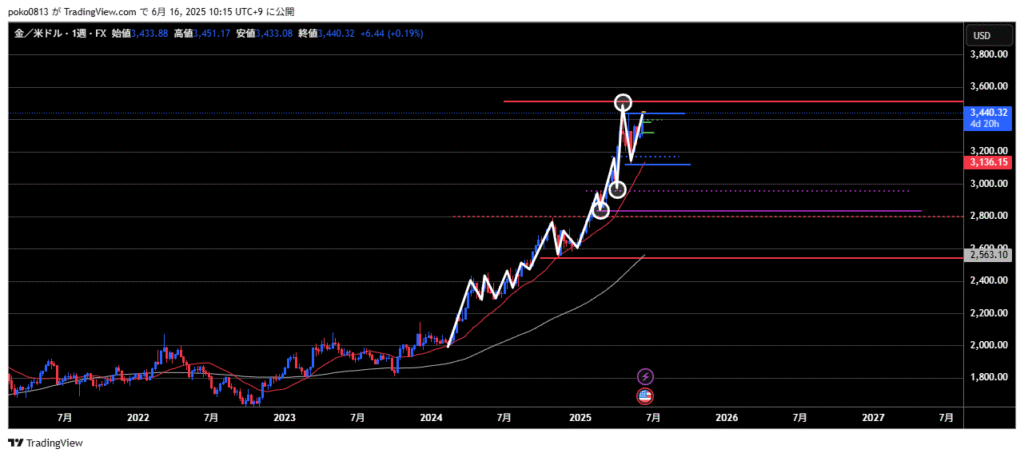

Daily

Uncertain whether to view the market as bullish within the 2965 to 3500 range or bearish within the 3125 to 3435 range.

The price may continue to range and fall, or break upward.

If the daily closes above around 3435, there is a high chance it will rise toward the previous high.

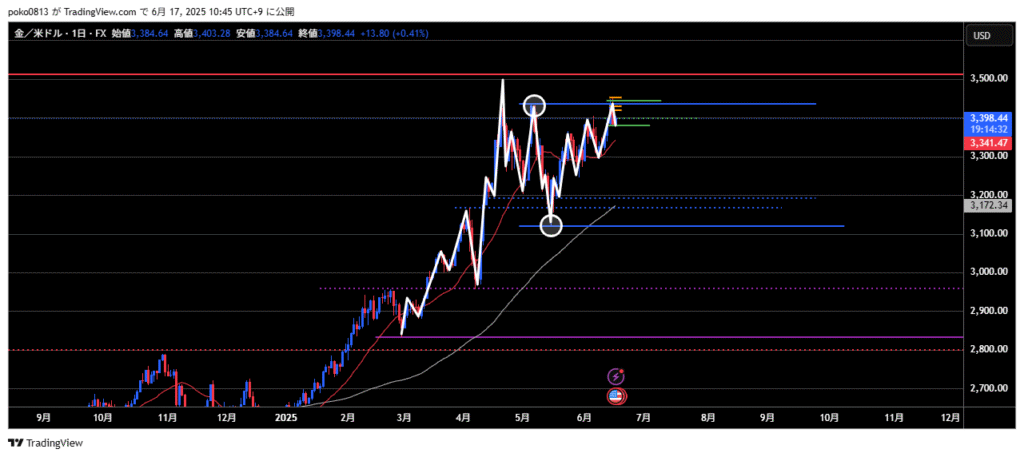

4-Hour

The recent high on the 4-hour chart has been broken several times with wicks, but no candle body has closed above it yet, so the uptrend continues.

The last swing low line is acting as support, and price is currently bouncing.

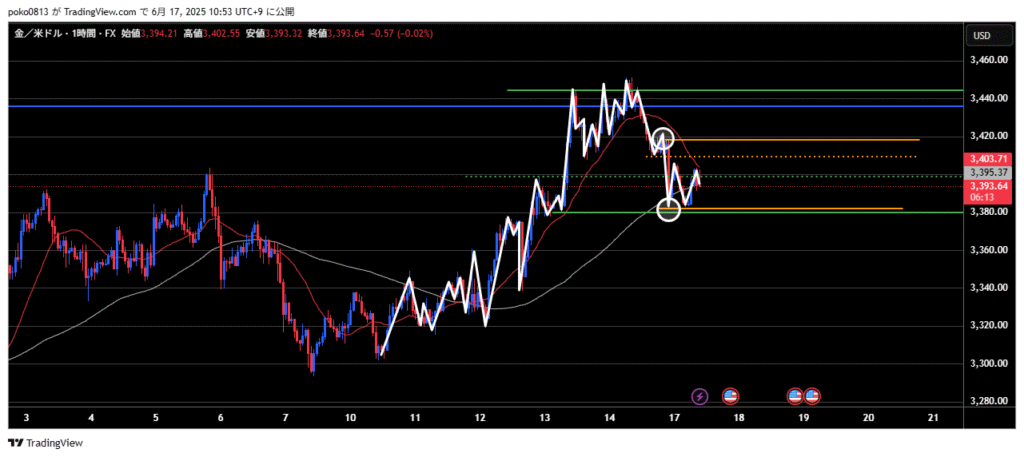

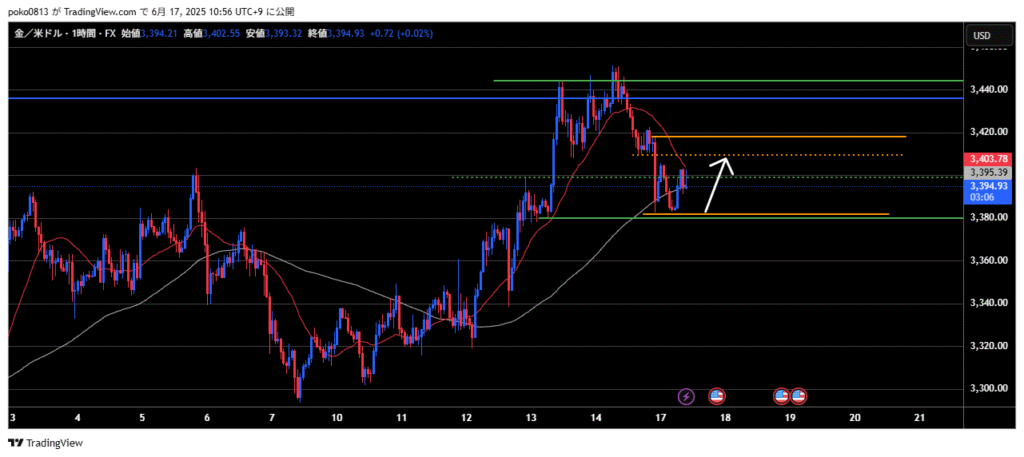

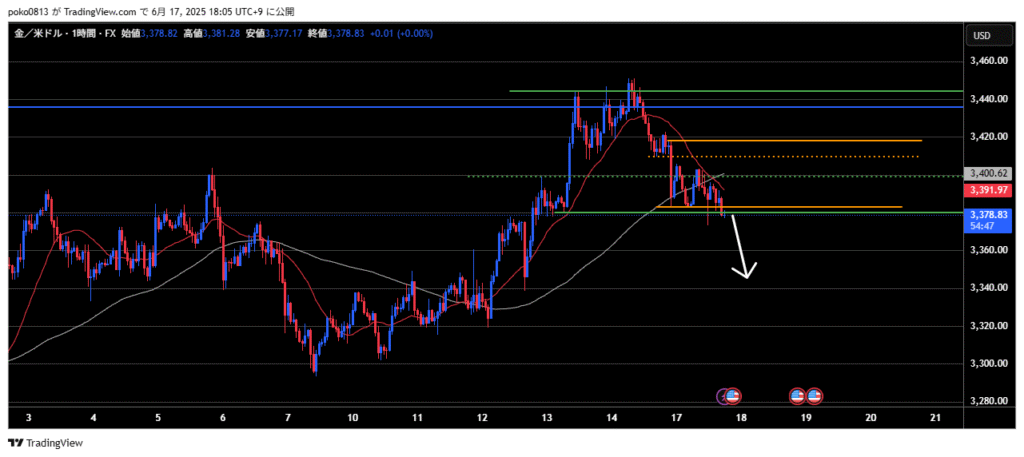

1-Hour

Yesterday, the last swing high was unclear, but the market has clearly switched to a downtrend as both highs and lows are lower.

Currently, the 5th wave down may have ended, and the price is ranging on the short-term chart.

Trade Strategies

Strategy①

This is a counter-trend trade against the 1-hour chart, but consider going long from the lower range, expecting support on the 4-hour chart.

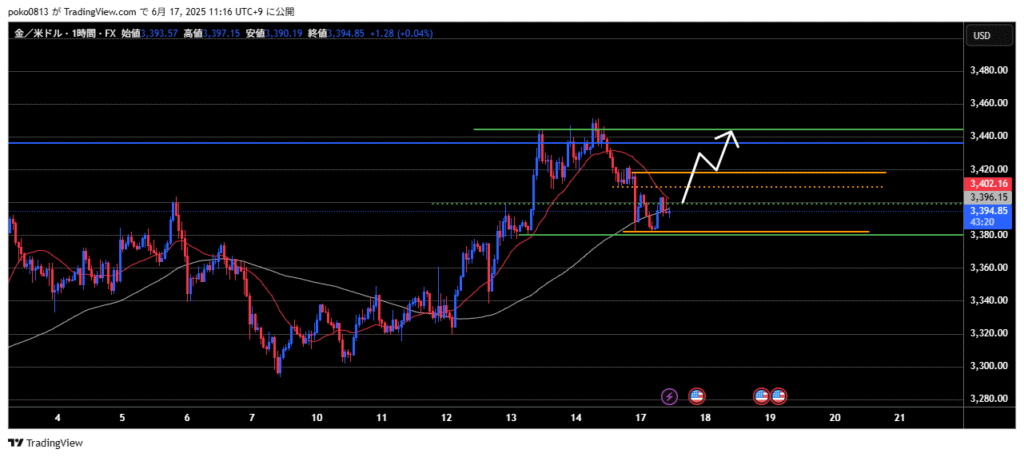

Strategy②

If the 1-hour chart turns bullish, target the 3rd wave up for a long entry.

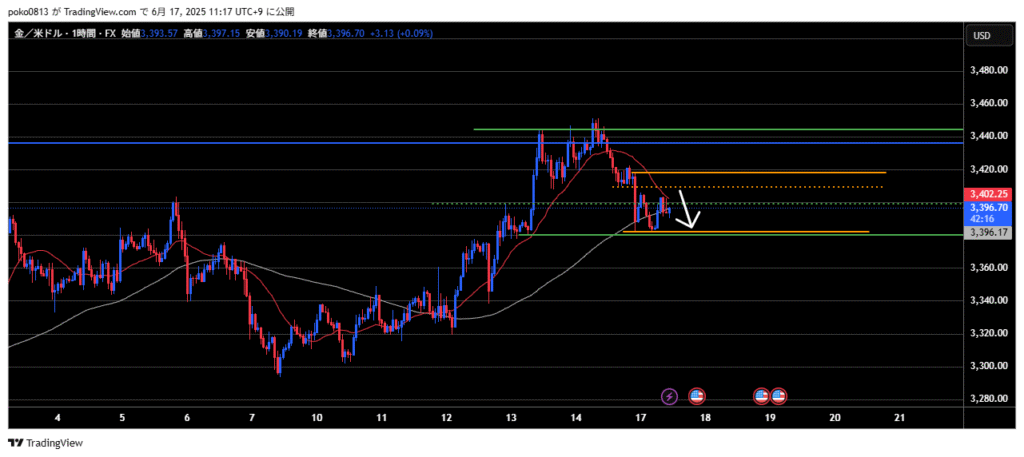

Strategy③

If the short-term chart remains in a range but looks like it may continue downward, wait for a pullback and consider shorting.

Postscript Trade Strategies

Strategy①

There appears to be strong downward bias, and both the 4-hour and 1-hour charts have slightly broken below important horizontal levels, so consider shorting.