USDJPY Market Analysis and Trading Strategies.

*Personal Opinion

Waveforms of each time leg

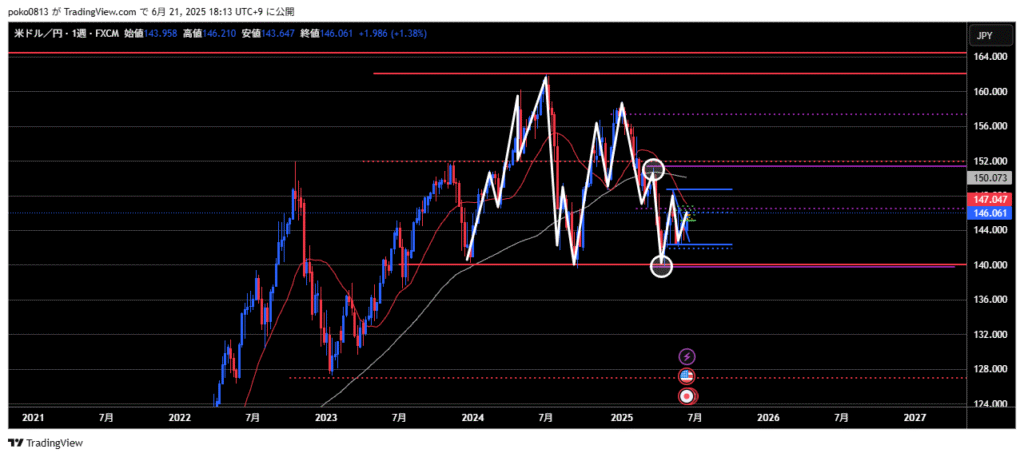

Weekly

Downtrend.

We are currently in a situation where the fifth wave of decline may extend further,

but it gives the impression that a reversal to an upward trend is starting to take shape.

There is still ongoing contention between the buying and selling forces,

and there is a possibility that volatility will continue to squeeze.

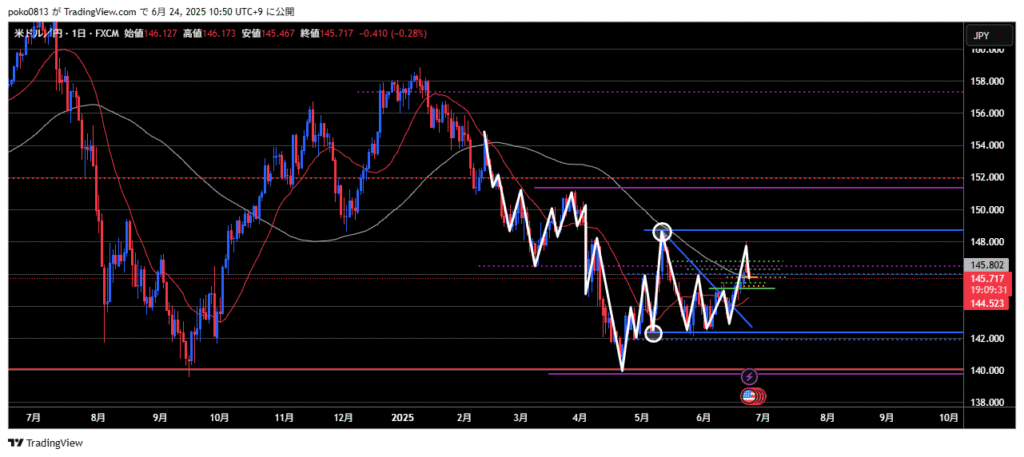

Daily

The bullish momentum picked up, pushing the price close to the recent high.

However, it was quickly pushed back down by a sharp candlestick wick — a clear sign of strong resistance.

Now, the price is hovering around the midpoint between ¥142.3 and ¥148.5, as if it’s taking a breather before deciding its next move.

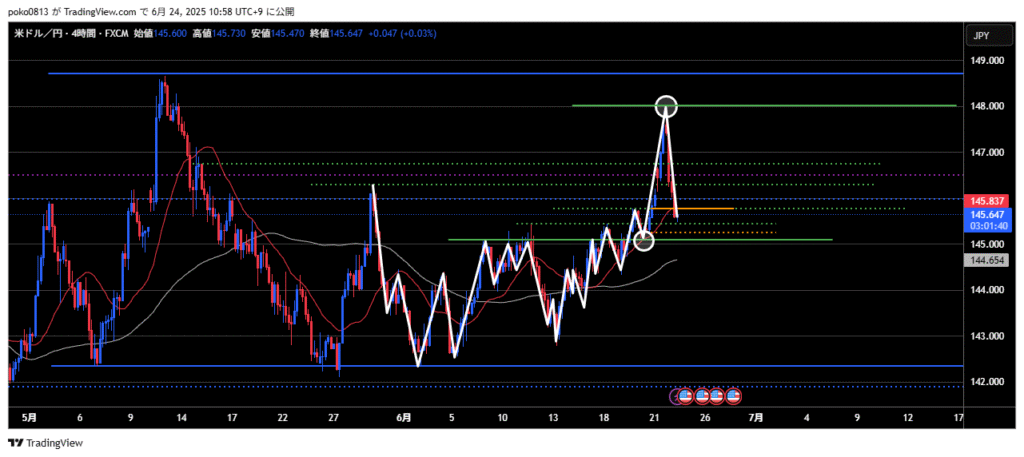

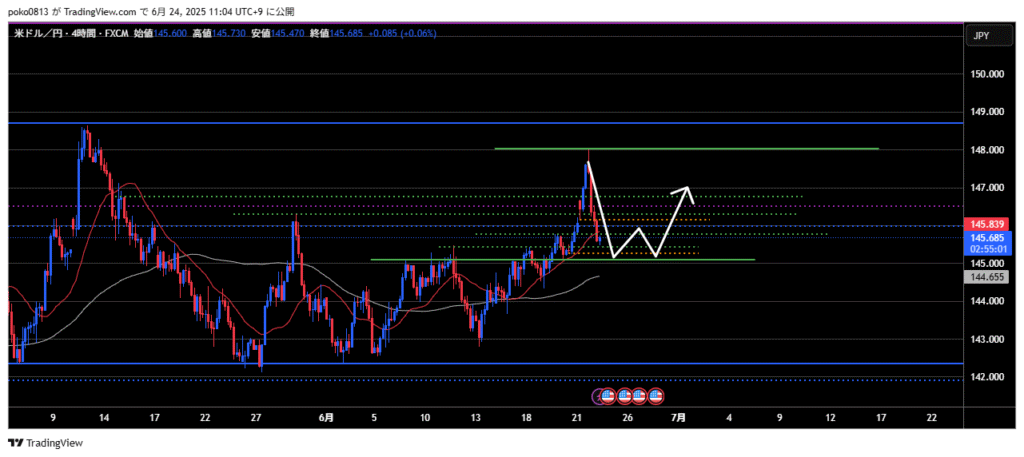

4-Hour

At the start of the week, the price surged and broke well above the recent high.

But after that impressive breakout, it got pulled back just as strongly.

Now, it’s returned close to the previous support zone near the last swing low — like it flew too close to the sun and had to come back down to Earth.

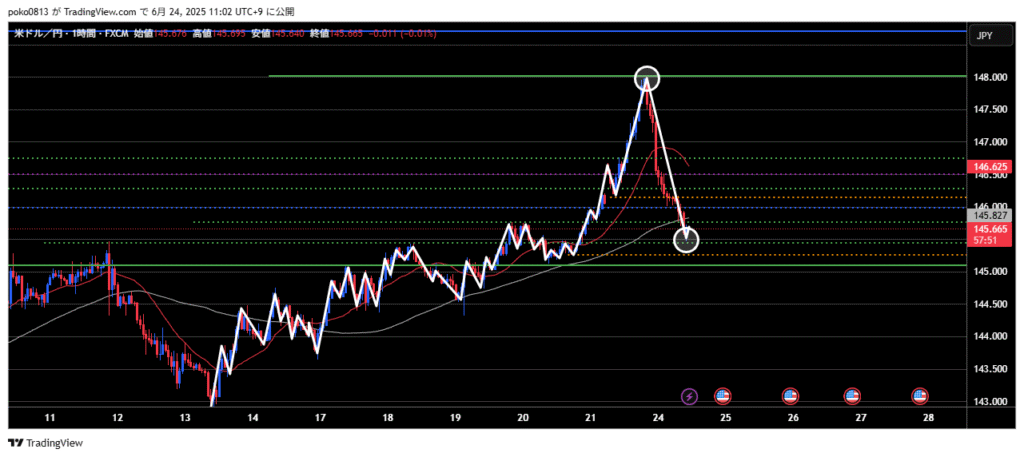

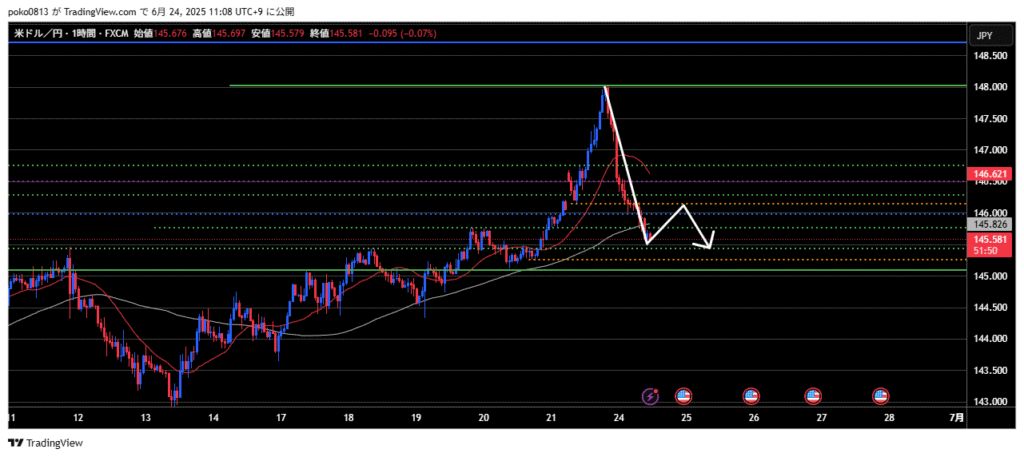

1-Hour

The week kicked off with a gap up, and after filling the gap, the price made a strong upward move.

However, things have taken a turn — it’s now broken below the most recent swing low, shifting the outlook to bearish.

Looks like the bulls ran out of steam, and the bears are starting to take the wheel.

Trade Strategies

Strategy①

The uptrend is still intact on the daily and 4-hour charts, so I’m watching for a potential long entry once this pullback finishes.

It doesn’t look like we’ll see a sharp V-shaped recovery — more likely, we could get a double bottom or some kind of base forming before the next leg up.

Patience might be key here — the market’s probably not in a hurry this time.

Strategy②

If the price makes a pullback on the 1-hour chart, I’ll consider a short entry aiming for the third wave of the downtrend.

However, with a key horizontal support level nearby, there’s a high chance the downside may be limited — so this would likely be a short-term position.

It’s important to remember that this current drop appears to be a correction on the higher timeframes, and I’ll be trading with that broader context in mind.