USDJPY Market Analysis and Trading Strategies.

*Personal Opinion

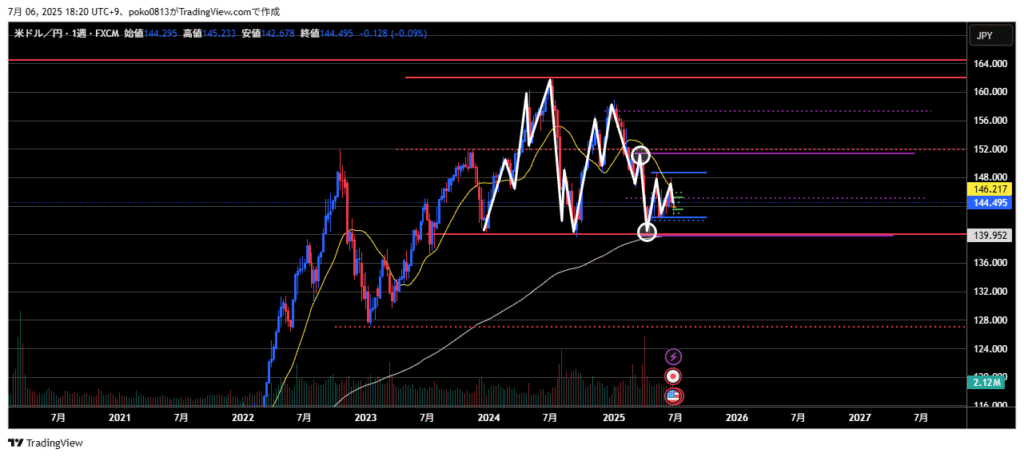

Waveforms of each time leg

Weekly

Downtrend.

Currently, the market is in a consolidation phase, possibly before the emergence of the fifth wave of the downtrend.

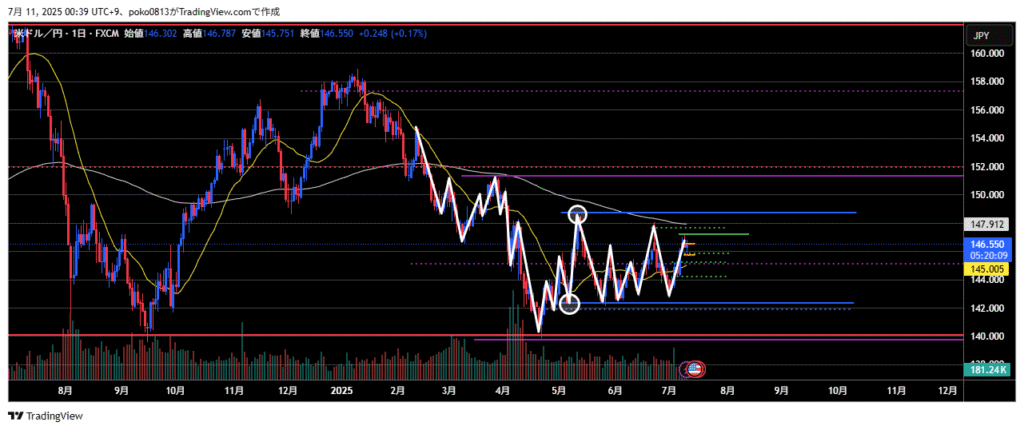

Daily

Bullish outlook.

A range has formed between 142.3 yen and 148.5 yen.

The price has rebounded near the lower end of the range and is now rising again, aiming for the upper boundary of the range.

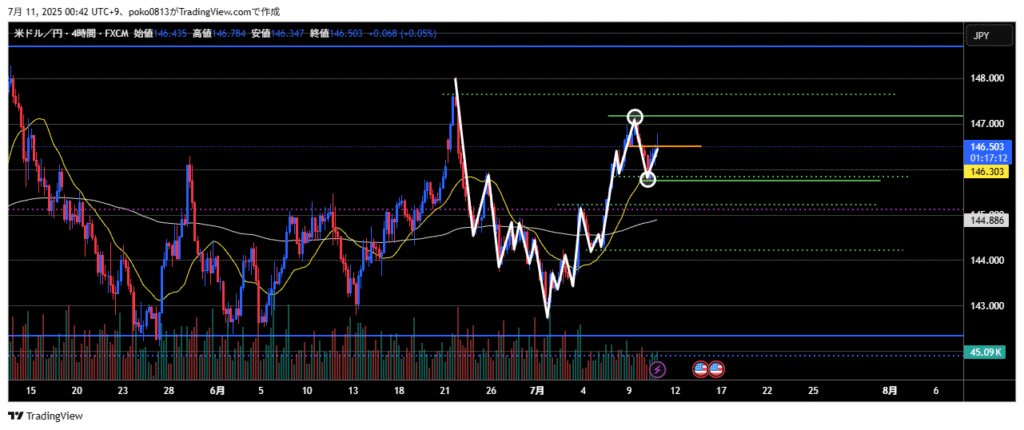

4-Hour

The last swing low of the uptrend has been broken to the downside, and the market is currently in a correction phase.

However, since the break is only slight, there’s a possibility it could be a false breakout. This uncertainty may lead to market indecision, causing volatility to squeeze.

It’s a situation where it’s unclear whether the uptrend will resume or a new downtrend is beginning.

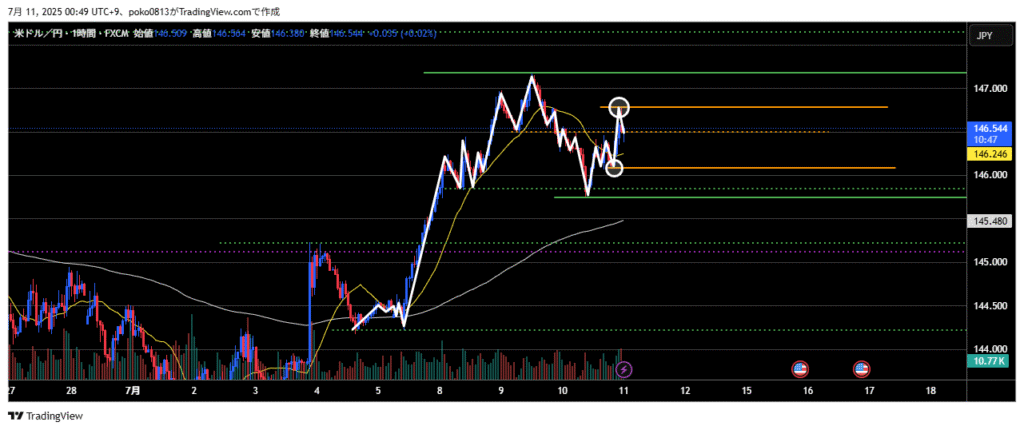

1-Hour

The last swing high of the recent downtrend is unclear, but the market is currently forming higher highs and higher lows, indicating an uptrend on the 1-hour chart.

It remains to be seen whether the price will rise toward the horizontal resistance on the 4-hour chart, or if it will reverse back into a downtrend.

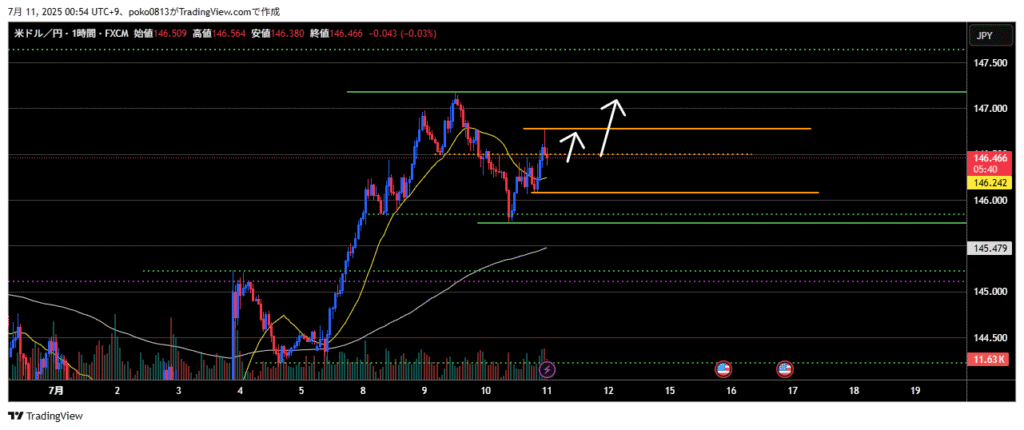

Trade Strategies

Consider riding the uptrend on the lower timeframes and look for a long entry targeting either the recent high on the 1-hour chart or the horizontal resistance level on the 4-hour chart.

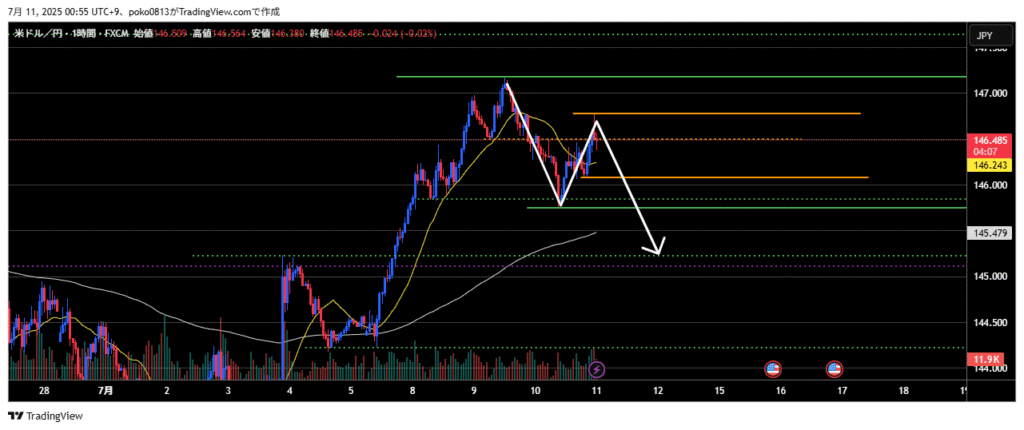

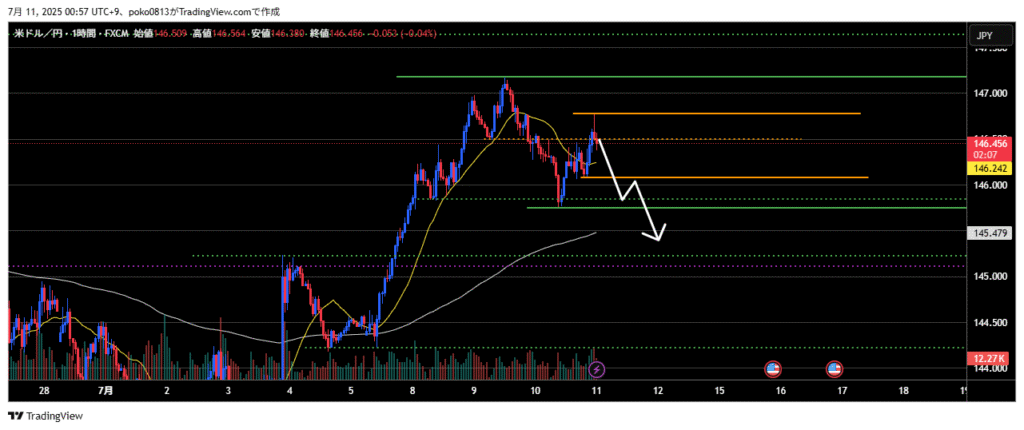

However, if the first wave of a downtrend has already formed on the 4-hour chart, there’s a possibility that the third wave of the downtrend could begin from the current price level.

Caution is needed, as this could mark the start of a stronger bearish move.

If the outlook shifts downward again on the 1-hour chart, selling pressure is likely to increase further.