USDJPY Market Analysis and Trading Strategies.

*Personal Opinion

Waveforms of each time leg

Weekly

A downtrend is currently in place.

Price is moving within the range between the recent low and the last swing high.

While the weekly chart maintains a bearish outlook, lower timeframes are showing an active uptrend, with price rising toward the most recent swing high on the weekly chart.

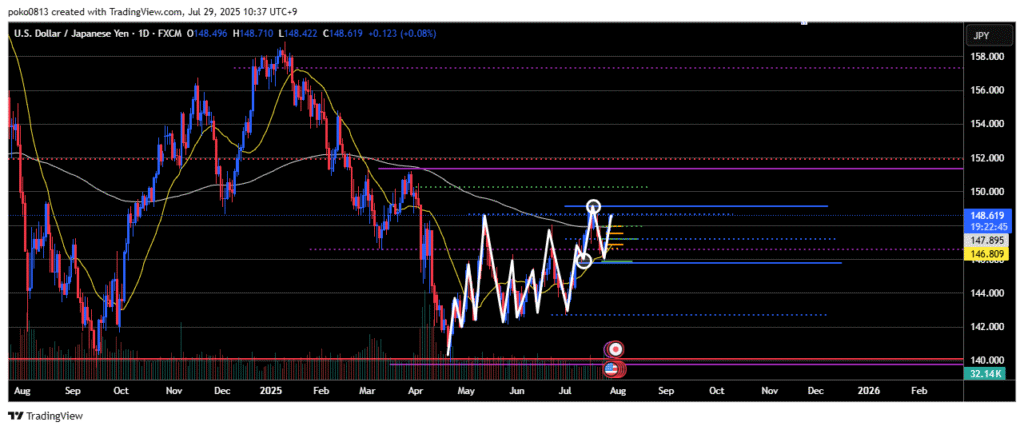

Daily

Higher highs and higher lows are forming, confirming an ongoing uptrend.

After a significant pullback down to the area around the most recent swing low, the price is now rising again, aiming for the recent high.

The key question is whether that recent high will act as a top and trigger a reversal, or if the price will break above and move into the 150 yen range.

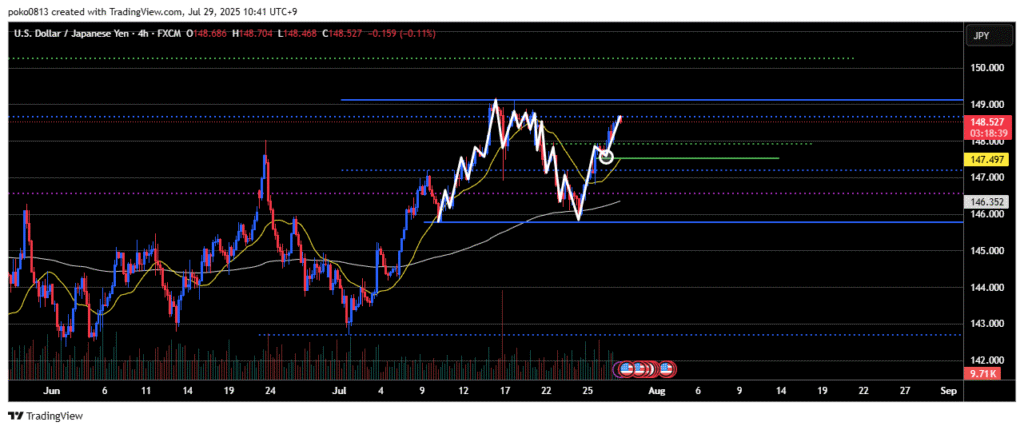

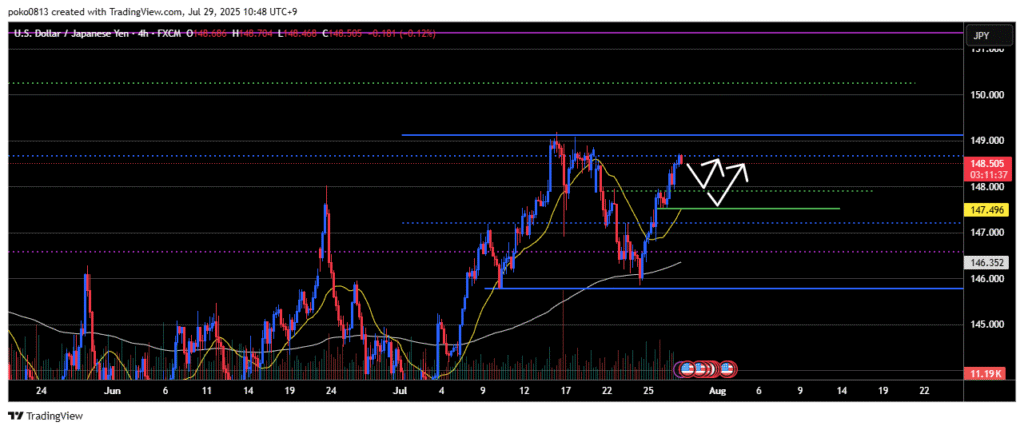

4-Hour

The price is rising without making a significant pullback, forming higher highs and higher lows—indicating a strong uptrend.

From an Elliott Wave perspective, this appears to be the 3rd wave of the pattern.

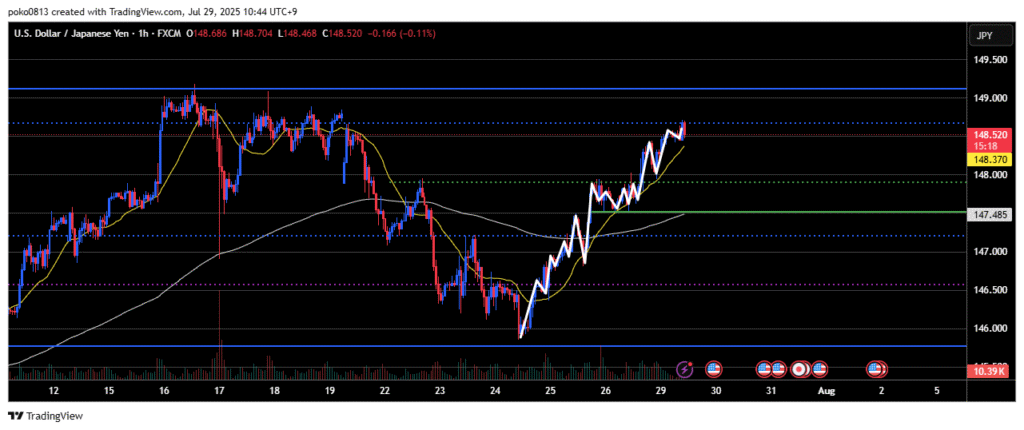

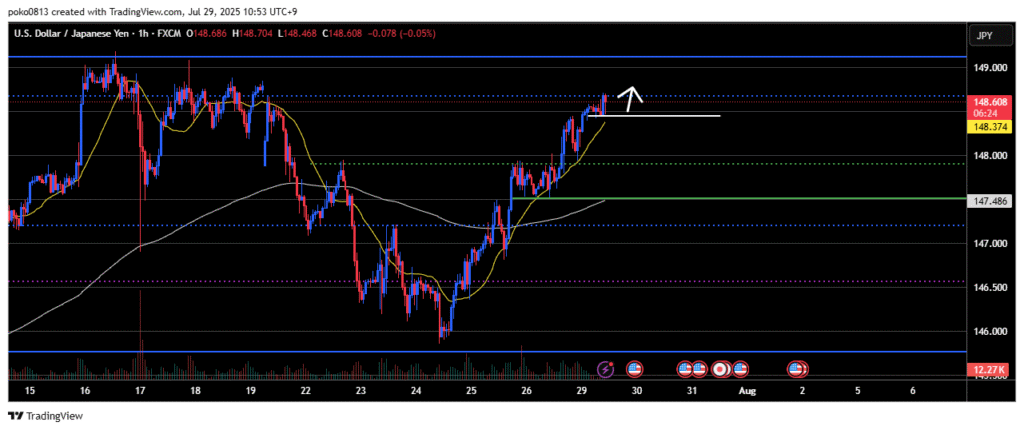

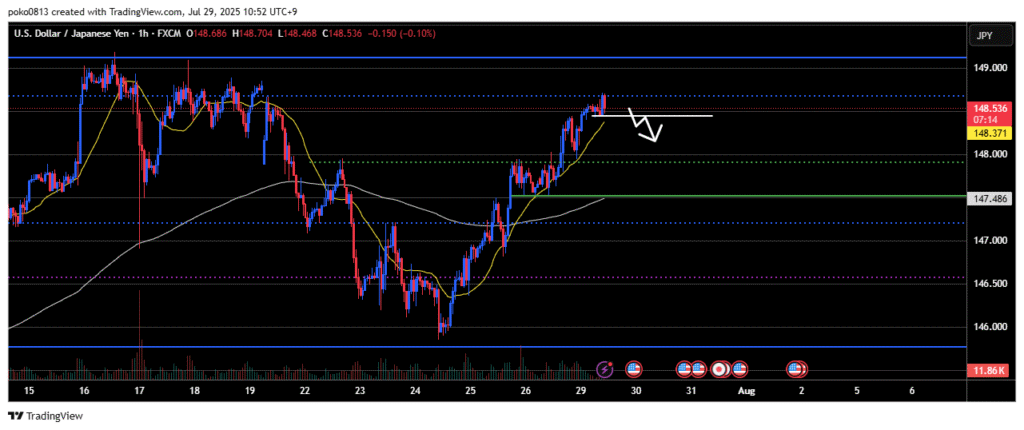

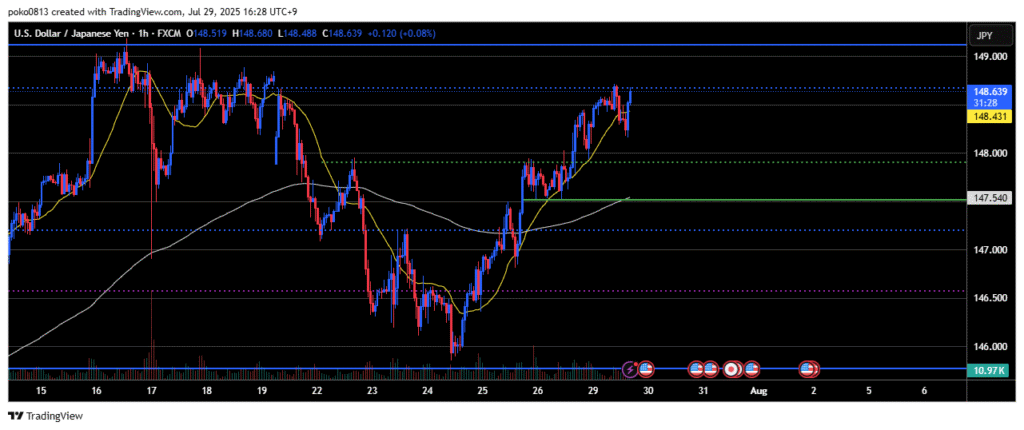

1-Hour

An uptrend is in place.

The recent high has been slightly broken, but for now, the price is being pushed back down from that level.

Trade Strategies

Waiting for a significant pullback on the 4-hour chart before entering a buy on the dip.

Potential entry zones include the previous high on the 4-hour chart or the area around the most recent swing low.

If the price clearly breaks below the last swing low, the long setup will be invalidated and the strategy will be reconsidered.

However, given the fine and shallow structure of the previous waves, it’s uncertain whether a substantial correction will occur.

A buy-on-the-dip setup is forming near what may be a new swing low on the 1-hour chart.

However, it’s still unclear whether this level is a confirmed swing low.

If the price breaks below the swing low area on the 1-hour chart, I’ll also consider a short entry on the lower timeframes.

Update

The price appears to be on the verge of breaking below a level that may or may not be a confirmed swing low.

On the 5-minute chart, this level is acting as the lower boundary of a range.

I’m currently watching for a pullback to short from on the 5-minute chart.

That said, since the 21-period moving average on the 1-hour chart is aligning with this zone, it’s likely that some traders are also eyeing this area for a potential buy on the dip.

This makes it a key battle zone between buyers and sellers, so careful observation of price action is essential.

Update2

The market has now transitioned into the European session, and there’s been a sudden, unexplained spike to the upside.

My short position was just stopped out.

I’ll hold off on any further trades for the rest of the day.