USDJPY Market Analysis and Trading Strategies.

*Personal Opinion

Waveforms of each time leg

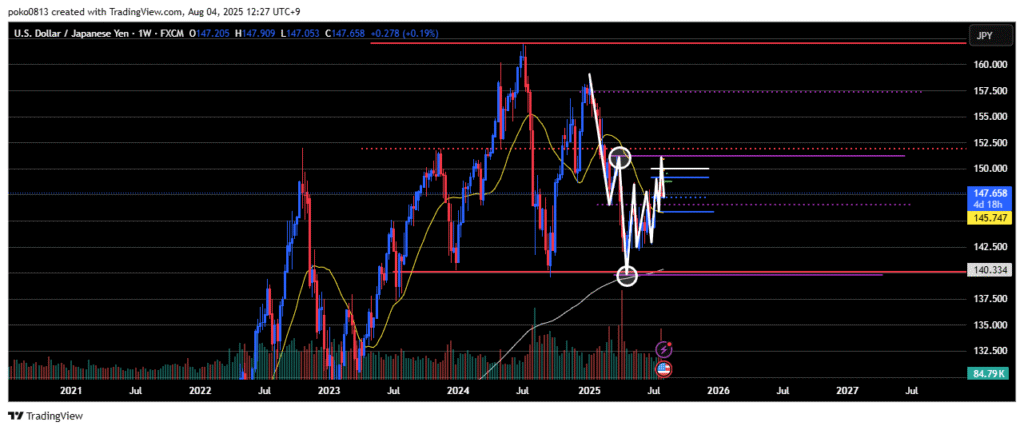

Weekly

Last week, the price climbed up to the area around the final swing high of the previous downtrend, but was strongly pushed back down—partly due to the impact of the U.S. Non-Farm Payrolls release.

Since that swing high level hasn’t been clearly broken to the upside, the weekly outlook remains bearish.

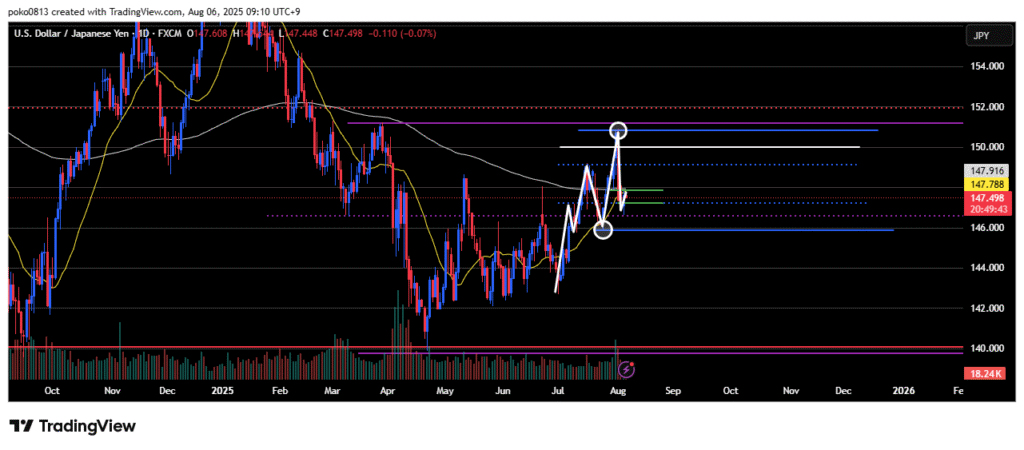

Daily

An uptrend is in place.

Although there was a sharp drop from the weekly swing high, the price has not broken below the last swing low, so the bullish outlook remains intact.

The price has bounced just before reaching the swing low area.

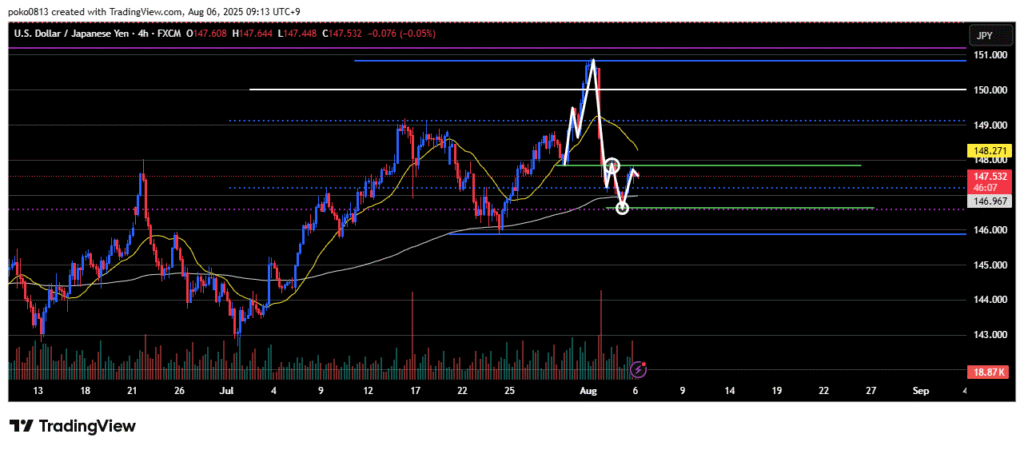

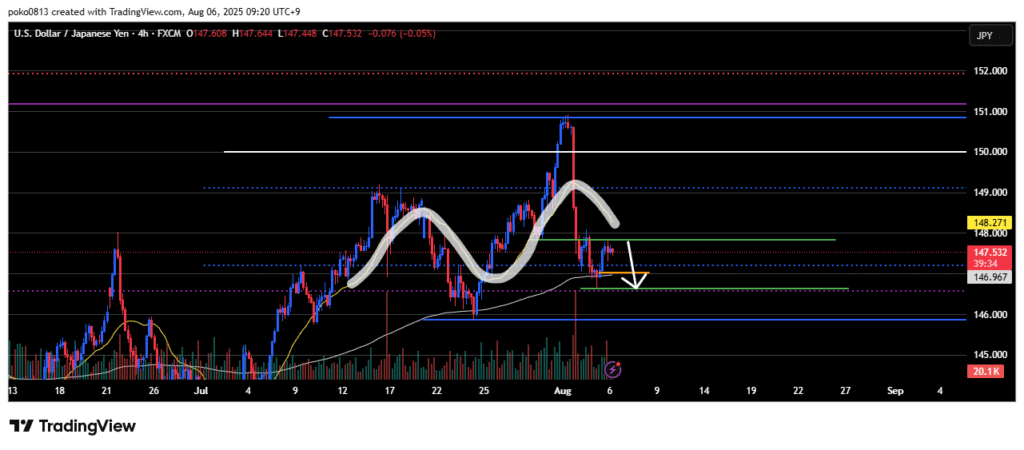

4-Hour

The trend has shifted from an uptrend to a downtrend.

Currently, the price is retracing toward the area around the most recent swing high.

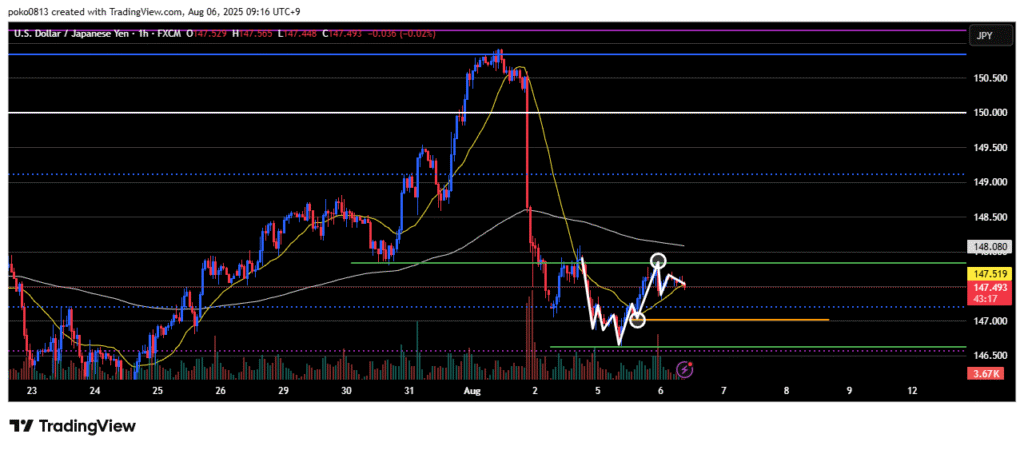

1-Hour

The trend has shifted from a downtrend to an uptrend.

After an initial bounce near the 4-hour swing high area, the price has now transitioned into a sideways movement on the lower timeframes.

Trade Strategies

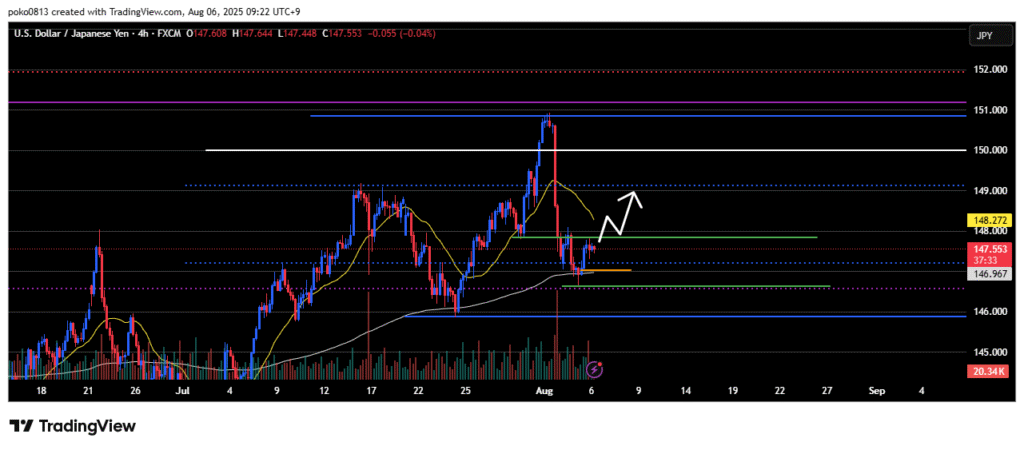

Look to short only after pulling back as close as possible to the 4-hour swing high area.

Also keep an eye on the 21-period moving average on the 4-hour chart for potential confluence.

If the price starts to gradually decline from the current level without a clear setup, I’ll stay out and wait.

If the price clearly breaks above the 4-hour swing high, I’ll switch to a long strategy.

This would shift the outlook to bullish on the daily, 4-hour, and 1-hour timeframes, meaning short positions would no longer be considered.