USDJPY Market Analysis and Trading Strategies.

*Personal Opinion

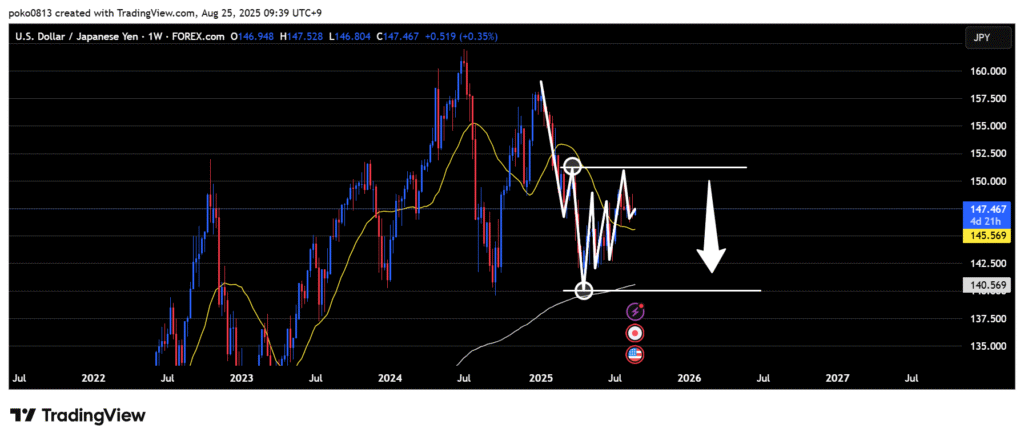

Waveforms of each time leg

Weekly

Downtrend.

The price once rose to the last swing high line but failed to break above it and rebounded.

The outlook remains bearish until the last swing high line is clearly broken to the upside.

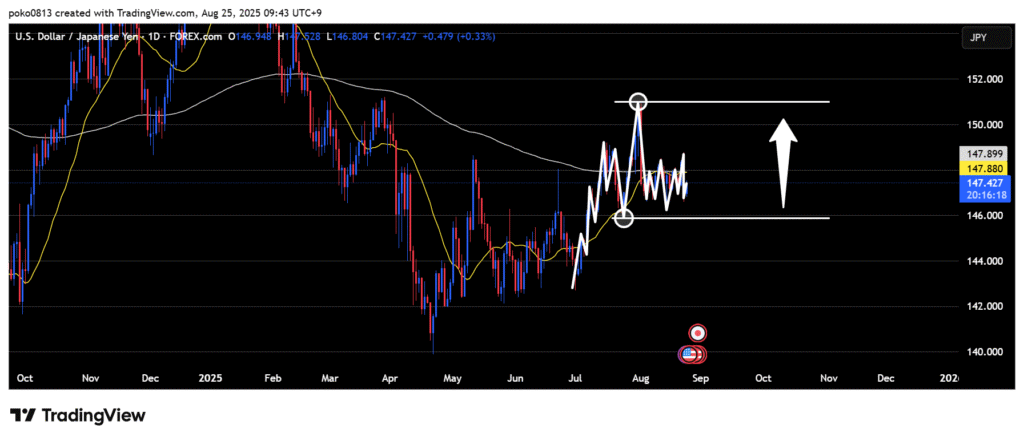

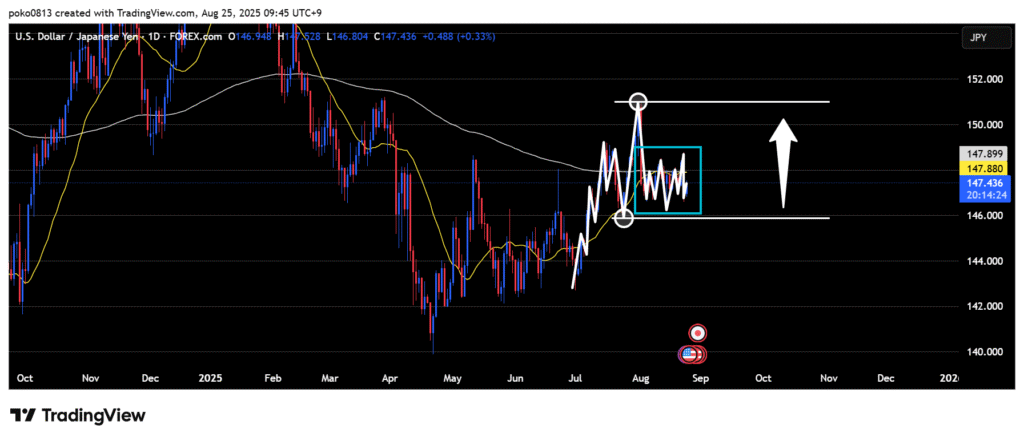

Daily

Uptrend.

The outlook remains bullish until the last swing low is clearly broken to the downside.

After falling to around the last swing low line, the market has entered a range.

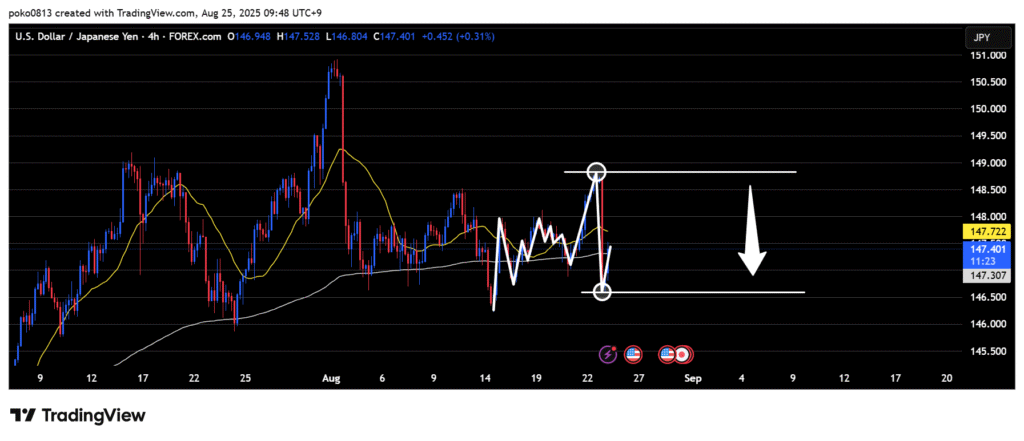

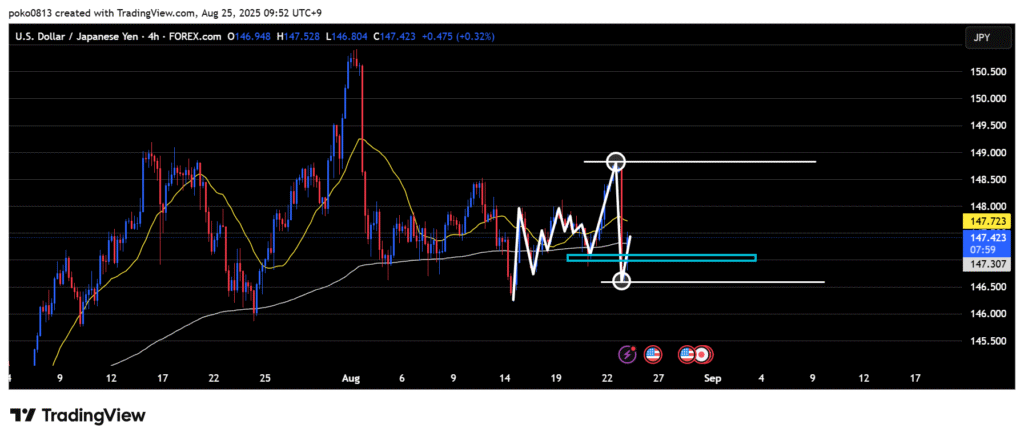

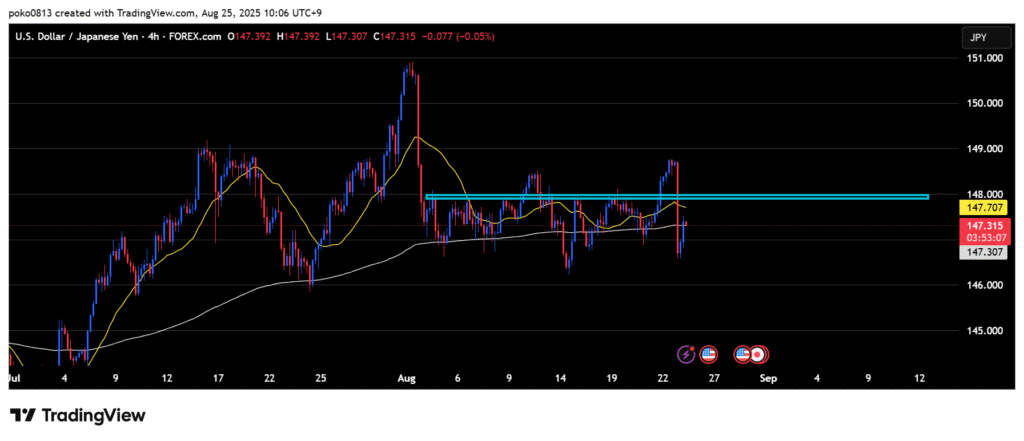

4-Hour

A downward Wave 1 has formed, breaking the uptrend and shifting the outlook to bearish.

The outlook remains bearish until the starting point of the recent lowest low is clearly broken to the upside.

It appears to be in a downward Wave 2, but since the trend reversal line (blue line), which was one of the potential correction-ending levels, has already been broken, it is uncertain how long the correction will continue.

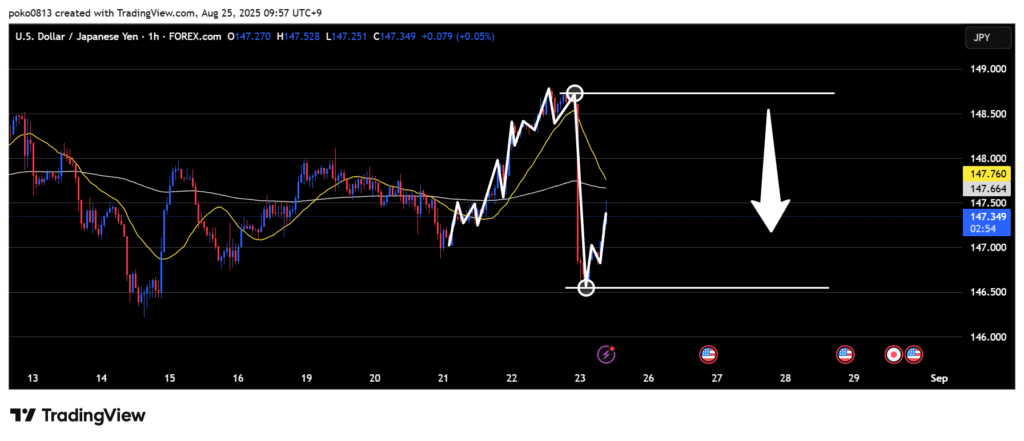

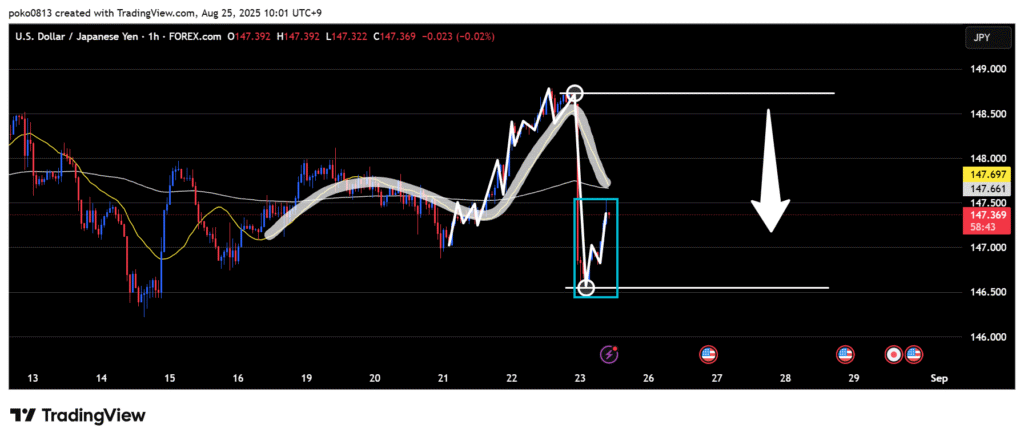

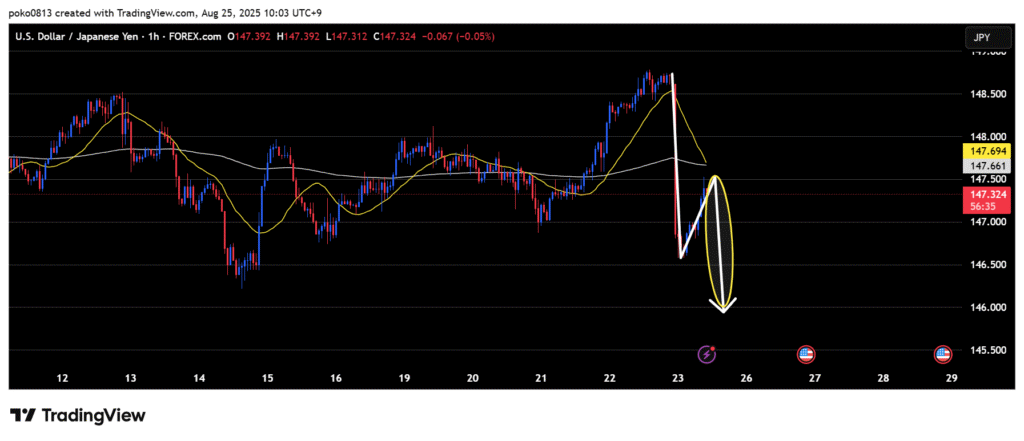

1-Hour

A sharp drop occurred, breaking the uptrend and shifting the outlook to bearish.

As with the 4-hour chart, the outlook remains bearish until the starting point of the recent lowest low is clearly broken to the upside.

An uptrend is currently forming on the lower time frames.

As potential pullback sell candidates, I will keep an eye on the 21-period moving average and Fibonacci levels.

Trade Strategies

I am considering a pullback sell targeting the downward Wave 3.

I will focus on the price action around the moving averages on the 1-hour and 4-hour charts.

I will only enter after confirming that the uptrend on the lower time frames has broken.

The blue line shown in the image is also being strongly respected, so I will keep a close watch on it.